Labor’s Capital: Why and How to Put Public Capital at the Service of Labor

Setting the Stage

Here in the United States, we have an economic system in which public capital—the publicly issued national money supply—is almost entirely consigned to private management in the interest of private sector capital investors, more or less irrespective of its effects upon working people. It is generated and allocated with little if any public control, and flows in ways that harm working people—both by widening wealth inequalities and by stimulating asset price bubbles that inevitably burst, leaving millions of working people indebted and out of work.[i]

Although this system has been entrenched for over a century and a half, it is possible to repair it and end the harms it does to workers by managing public capital—what I’ll call ‘Labor’s Capital’—publicly and private capital privately. Existing law provides us with most of the structure required to do this. All that is needed is a re-appreciation of the original purposes of our institutions and an associated re-appropriation of those institutions’ original mandates.

Without acknowledging it, we have already begun this process in the form of financial support programs established by the Federal Reserve System (the Fed) in response to the present pandemic. These programs have grown the Fed balance sheet to $9 trillion in only 6 months.[ii] In what follows, I show how we can accelerate economic reform to benefit working people. But first, it is necessary to review some fundamental economic principles as well as the history that has brought us to the current juncture.

Private Production and Public Finance

Every society faces three fundamental choices in how to manage and finance productive activity: through private management; through centralized public planning; or through the creation of a hybrid or ‘mixed’ public-private economy. [iii]

If we choose mainly private management of production, as the U.S. has done to a large extent, then another set of choices, concerning the financing of production, arises: whether to enable labor to rent capital (pay interest) in production; to enable capital to rent labor (pay wages) in production; or to enable some form of mixed system of labor/capital codetermination in planning, executing, and financing production, as is nowadays done in Germany.

Now as noted, from the earliest days of our ‘commercial republic,’ we have left the management of production largely in private hands. But with regard to financing of production we have been much more ambivalent.[iv] For the past one hundred sixty years, our financial system has been hybrid in character. On the one hand, we have vested primary authority for the issuance and modulation of our supply of investment capital—the national money supply—in federal instrumentalities.[v] On the other, we have delegated primary responsibility for the allocation of our publicly generated investment capital to private-sector lending institutions licensed by public authority.[vi]

“Public capital, private management” has been our mode of financial hybridity. We have combined it with private capital ownership of enterprises that rent labor “at will”—the default working relationship for most non-union workers in the U.S., which allows bosses to fire employees for any reason or no reason at all. The upshot is a system in which public capital, consigned to private management in the interest of private-sector capital investors, operates to the detriment of working people, continuously deepening economic inequality.[vii]

A “deep structure” reason for all of this is the prevalence of collective action predicaments, situations in which multiple individually rational decisions aggregate into collectively irrational outcomes.[viii] They occur wherever we find stratified capital markets (“primary,” “secondary,” or “derivative”) and indefinitely extensible public credit.[ix]

. . . [P]ublic capital, consigned to private management in the interest of private sector capital investors, operates to the detriment of working people, continuously deepening economic inequality.

In such cases, it becomes rational for individual private-sector financiers to seek massive short-term profits by betting unproductively on price movements in financial markets rather than investing in product markets. This is why even well-meaning capital-owners can’t solve our problems on their own. It is also the reason why—as a rational society comprised mainly of working people—we cannot permit things to continue on their present course.[x]

Toward a Capital Commons for Workers

Private production conducted primarily for private profit is not compatible with private financing conducted with public capital for private profit. The only way to get public capital allocation right, and thus to get credit modulation and long-term productive investment right, is to manage public capital (Labor’s Capital) publicly and private capital privately. We can see how to do that through the simple organizing framework of a public balance sheet, conceived as a central bank balance sheet—in effect, the ledger of our working citizenry’s capital commons.

On the asset side of this ledger, restoring our regional Federal Reserve Banks to their original status as a network of regional development banks would ensure that all assets financed with public capital are productive assets, not merely profitable ones for Wall Street investors.[xi] On the liability side would be the provision to all citizens, businesses, and legal residents of digital Peer-to-Peer (P2P) Citizen and Business Wallets. An upgraded ‘People’s Fed’ would issue ‘Democratic Digital Dollars’ through these electronic wallets.[xii]

The establishment of a National Reconstruction and Development Council—modeled on the Federal Stability Oversight Council—would complete the picture. Such a council would include the heads of all cabinet-level executive agencies with jurisdiction over infrastructure and industry, enabling perpetual democratic determination of what nationally counts as development and, therefore, as productive.[xiii]

Understanding Public and Private Capital

Understanding the concept of a Capital Commons requires a fuller understanding of capital itself and how it works. Classically, capital is any non-human accessory to production—for example, machines, tools, and factories. In non-barter exchange economies like ours, however, capital also takes monetary form. In effect, it is purchasing power, deployed in the acquisition of such things as raw materials, machinery, and workspace.

It is common to call capital of this kind “investment capital,” which we distinguish from “speculative capital”—a variant species, made possible by monetization itself, which aims to profit by short term changes in financial market prices. (Hence the often-heard comparison of Wall Street to a casino.) The divergence between investment and speculative capital is not the sole source of our dysfunctions of the last several decades, but it is easily the worst accelerant.

In what sense is the greater part of investment capital now ‘public’? The answer resides in monetization. If banking and finance were merely a matter of intermediating between private accumulators and end-users of capital, all capital would be in a certain sense private and, on that account, unproblematic. There would be inherent limits—no more capital could be gambled with than had been already privately accumulated. Banks would be mutual funds.

But banks are not mutual funds. They do not rely on deposits to fund loans. To the contrary, banks are sites of public credit generation and monetization. They lend on the basis of perceived profit potential. Through its central bank—the Fed—the laboring public then ratifies bank decisions by recognizing payments made from accounts credited by lending banks as legal tender.

In this sense, where banks are concerned, loans create deposits, and monetized investment capital is accordingly (a) publicly generated, (b) endogenous, and (c) indefinitely extensible rather than finitely pre-accumulated. This all takes a bit of tracing to substantiate, and in doing so, we can demystify those three technical terms—terms that Wall Street generally prefers to keep somewhat obscure.

Say you or a group of coworkers, need a loan to finance a project you have conceived—one that you’re sure will be profitable. You need buying power to purchase your project’s inputs, but all you have are your own private promissory notes—your IOUs. These notes are not legal tender, not recognized as money. They can’t serve directly as monetized investment capital.

So you go to a bank to exchange your private promissory notes temporarily for public promissory notes. These do count as legal tender, as money, and hence purchasing power usable to finance production. What makes such private note / public note swaps possible is that the bank is a publicly licensed institution, networked into our national payments system. At the center of that system sits the Fed, our central bank and a public instrumentality that oversees banks chartered by yet other public instrumentalities.

You can spend this credit immediately. It is monetary from the get-go. You simply insert a chip, swipe a strip, or key a blip, and you’ve paid for the inputs to your bank-financed project . . .

If a bank approves your swap—a.k.a. loan application—it is either going to open an account in your name; credit an account already there in your name; or provide you with a check, instructing someone else to credit an account in your name. You can spend this credit immediately. It is monetary from the get-go. You simply insert a chip, swipe a strip, or key a blip, and you’ve paid for the inputs to your bank-financed project, be they machine tools or a workspace.

The Creation of ‘Bank Money’: A Risk and an Opportunity

Is it really that simple? Yes, it is.

Basically, a functioning money is just “that which pays” in a payments system —“that which counts” in a system of debit and credit and value accounting.[xiv] And it is we, the public who constitute our republic, who determine what shall pay, what shall count, and who shall disseminate money when we generate it, ex nihilo, through public-private note swapping, a.k.a. bank lending. It was the great, but little known, Swedish economist Knut Wicksell (1851-1928) who dubbed this stuff “bank money.”[xv] Bank money’s endogeneity—that is, its susceptibility to public “creation” and dissemination ex nihilo—is sometimes referred to as “the alchemy of banking,” and confronts us with both great risk and great opportunity.

The risk has been manifested dramatically in recent decades. We have seen the misallocation of public credit from productive, labor-benefiting uses to labor-harming speculative uses; consequent poor modulation and associated bubbles and busts in multiple Wall Street markets; and long-term under-production, leading to secular stagnation in our real—i.e., productive—economy.[xvi] On the other hand, such risks can be transformed into opportunities, allowing us to restrict public allocation of public credit solely to labor-benefitting productive use, thus enabling continuous national development of working people’s productive power.

But why does bank money render sustained private production dependent on a public hand to guide production’s finance in the interest of labor? The answer is surprisingly straightforward. It resides in concepts of both profitability and market failure.

Profitability, Bank Failure, and the Divorce between Capital and Production

To understand the impact of the profit principle, let’s come back to your bank loan. The bank is going to evaluate your proposed project before approving your proposed swap. In evaluating your loan application, the bank will ask itself whether you’re apt to succeed with your project.

The bank, if it is to survive, will address this question by reference not to production, but to profit—your likely profit, whether you are a group of workers looking to rent capital or a group of capitalists looking to rent labor.[xvii] This is the rational thing for the bank to do in a system where not only production, but also the finance of production, is left to market exchange. As we know very well, much of how bank money affects the real economy, and hence labor, hinges on the profit imperative, whether the profits are earned by producing or merely by gambling.

This imperative is even enshrined in our bank-regulatory system, whose primary purpose is to police a bank’s safety and soundness. The term “safety and soundness’” reflects the law’s aim of preventing bank failure—i.e., lending unprofitably in ways that bring losses, thereby endangering depositors or their public proxy, the Federal Deposit Insurance Corporation (FDIC).

You can profit by gambling in Vegas or on Wall Street even though this produces nothing, but simply transfers wealth from the slot machine or the derivatives trader to the gambler.

None of this would be problematic if profits and production were inherently coupled or even proximately linked, such that production would ‘take care of itself’ just so long as we ensured financial profitability. But alas, the monetization of investment capital enables a divergence between profits and productivity. (You can profit by gambling in Vegas or on Wall Street even though this produces nothing, but simply transfers wealth from the slot machine or the derivatives trader to the gambler.) Moreover, the outsourcing of public capital management to profit-driven private sector financiers guarantees that divergence and, with it, the emergence of recurrent crises, arising from the pursuit of short-term profits, rooted in that form of market failure referred to earlier as the collective action predicament.[xviii]

The Fed: Past, Present, and Future

The central tension at the heart of modern capitalism as we conduct it in the U.S. is that production, ungoverned by labor or the public, is in the long run incompatible with finance ungoverned by labor or the public. This distinguishes us from Germany for example, where capital and labor co-determine much production.

The central tension at the heart of modern capitalism as we conduct it in the United States is that production, ungoverned by labor or the public, is in the long run incompatible with finance ungoverned by labor or the public. . .

If we are to address this central weakness in our system, reform of the Federal Reserve is essential. We must cease restricting the Fed to the role of a macro-monetary modulator and restore its earlier, complementary role as a micro-monetary allocator—recreating it as something akin to the network of stripped-down regional development finance institutions as it once was.

These regional institutions can ensure that public promissory notes (dollars) are swapped for private promissory notes (commitments to repay loans) only for productive and labor-benefitting purposes, not for speculative and labor-harming investment projects. A closer examination of the Fed shows how this could be done.

The Fed is a “system” because it comprises multiple distinct nodes of collective agency at two distinct levels. The Fed Board exists at the scale of the nation-state, while regional Federal Reserve Banks function at the subnational scale.

Regional Feds, established under the 1913 Federal Reserve Act, were originally meant to assist with the local financing of productive rather than speculative business development across our nation’s many distinct regions.[xix] They did this by monetizing (which the Federal Reserve Act calls “discounting”) what was called “eligible” (that is, productive) commercial paper.[xx] This meant directing the flow of public investment capital in productive and labor-benefitting ways. [xxi]

The Fed Board in Washington, D.C. was, in turn, meant to coordinate all of this regional financing, to ensure the coherent functioning of regional public capital disseminators and to avoid misallocation and, with it, the risk of inflation, deflation, bubbles, or busts.

The story of how we lost this arrangement is complicated.[xxii] For our purposes here, it’s enough to say that losing it was a tragedy, one that affects us to this day. But this tragedy is as much an opportunity as a loss. For it shows us what is needed to direct our monetized full faith and credit—our public capital—toward productive and labor-benefitting uses as the founders of the Fed originally envisaged.

Publicly Managed Public Capital; Privately Managed Private Capital

With lessons from our history and practical tools provided by existing law, we have the ability to re-found and re-energize our primary institutions of public finance. There are only a few things we need to reconfigure in order to take public capital back under public management for the sake of our working people and their productive industries, leaving only bona fide private capital to private management. What remains is to become more deliberate—and transparent—about new allocations of public capital, such as those made during the Covid-19 crisis.

With lessons from our history and practical tools provided by existing law, we have the ability to re-found and re-energize our primary institutions of public finance . . . to take public capital back under public management for the sake of our working people and their productive industries . . .

The best way to do this is to conceive of the economy as a comprehensive public or central bank balance sheet—a sort of citizens’ ledger—and manage it as such. That means thinking systematically about both public assets and public liabilities.

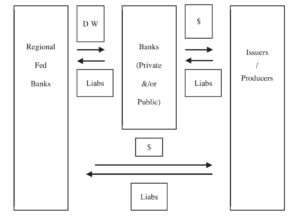

Figure 1. Reformed bank/“spread fed”/producer relations. Researched and created by Robert C. Hockett. Reprinted with permission.

Spread the Fed

Let’s start with assets.[xxiii] An asset is generated each time a loan is extended. Bank loans are assets on bank portfolios. Private sector bank loans effectively tie asset value to project profitability, which is a very good idea if profitability means productivity. But, if profitability and productivity are divorced from one another, it becomes problematic.

Our challenge, then, is to remarry profit and production. We can do that by fine-tuning what we do now—require private sector lenders and other financiers to finance projects in either of two ways, each keyed to the source of the capital to be invested. For privately originated, already saved capital, let private sector lenders and financiers invest as they wish, consistent with regulatory and criminal law; for publicly generated, Fed-monetized credit, on the other hand, require pre-approval of projects by regional Fed banks. And require these banks to evaluate projects by reference not simply to profits, but also to production and labor well-being.

As we continue to struggle with Covid-19, the present moment is an opportune time to make the regional Feds into development banks again. The Fed’s new Municipal Liquidity Facility (MLF) and its Main Street Lending Program (MSLP) were developed to aid our states, municipalities, and small businesses nationwide in riding out and reversing the devastation of the present pandemic. [xxiv] While these programs are brilliant in conception and potential, they are absurd in their present administration.

The MLF is administered entirely out of the Federal Reserve Bank of New York in Lower Manhattan. The MSLP is administered out of the Federal Reserve Bank of Boston. While the staffs of these institutions are very able and creative, they are tiny in number and isolated in the Northeast. To ask them to sort out the needs of small businesses in O’ahu, Hawaii or Billings, Montana—to deal with the problems of Tonya’s Tractor Repair in Tyler, Texas or Hank’s Hardware in Halfway, Oregon—is to do them and their beneficiaries—and all working people—a great injustice.

What should we be doing? Spread the Fed. Let Dallas handle Tulsa; and let Cleveland handle Ashtabula, Ohio. Let Kansas City look after the financing needs of Packer Plastics in Lawrence, Kansas; and let Atlanta take care of Mimi’s in New Orleans. Do that, and the Fed’s role in publicly managing and investing our public capital will look as depicted in Figure 1. In the figure, “DW ”means Fed Discount (i.e., lending) Window and “Liabs” means liabilities. In this scheme, regional Fed Banks lend to issuers or to public and private banks that lend to issuers, solely for projects reasonably likely to prove productive and benefit labor.

Digitize the Dollar; Widen the Wallets

Corresponding to the asset portfolio on the left-hand side of any balance sheet are the asset-holder’s liabilities on the right-hand side. [xxv] The Fed already issues the principal tradable public liability that all of us now use in purchasing, paying, producing, and speculating—the Federal Reserve Note, better known as the dollar. The Fed also maintains a system of Reserve Accounts for our banks, thereby operating as a “bank to the banks”—i.e., the central bank. It uses those accounts both as a tool of monetary policy (partly through Interest on Reserves) and as a liquidity management device (partly through Reserve Requirements).[xxvi]

In effect, then, the Fed already stands between banks and non-bank entities whose issuances it presently holds in its asset portfolio. In normal times, these assets are principally Treasury Securities and Government Agency Securities. They are supplemented by mortgage-related and additional private sector issuances during times of recession and now during the pandemic. What I propose is simply to add productive and labor-benefitting private sector loans to the asset side of the Fed’s portfolio. What then would we add to the liability side of this portfolio? The counterpart would be to add interest-bearing private sector P2P digital wallets (electronic accounts like Venmo or Zelle that can store cash and make payments) to the liability side of the public balance sheet.

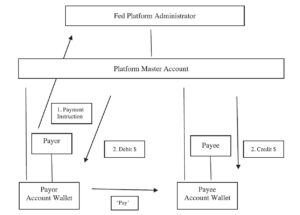

This is how the Fed can and must round out and complete its pandemic-prompted balance sheet expansion as it (1) transitions to issuance of a digital dollar and (2) upgrades FedNow, a national payments platform to permit real time clearing and settling of transactions.[xxvii] All it needs to do is add digital citizen banking and business banking to its current bank banking. Here is how it would work:

First, every citizen, business, and legal resident would receive an interest-bearing digital wallet—call it a Democratic Digital Dollar (3D) Wallet. This wallet would be accessible by desktop, laptop, smartphone, or other device. Each wallet would be endowed with vertical connectivity to a master account on the liability side of the Fed balance sheet and ‘horizontal’ (P2P) connectivity to all other wallets.

. . . [E]very citizen, business, and legal resident would receive an interest-bearing digital wallet—call it a Democratic Digital Dollar (3D) wallet. This wallet would be accessible by desktop, laptop, smartphone, or other devices.

I call the resultant digital payments platform the ‘Democratic Digital Dollar,’ or ‘3D’ platform, at the national level. [xxviii] Wallet holders are enabled to pay taxes, licensing fees, and other remittances, as well as to receive tax refunds, program moneys, and other disbursements along the platform’s vertical dimension. Then they can also make real time payments to one another along its horizontal dimension.

It is that simple. Presently private-sector banks hold private loans on the asset sides of their balance sheets and corresponding private demand deposits (checking and savings accounts) on the liability sides. All we are doing is moving the public capital involved in both of these to a public balance sheet, leaving all that involves only private capital as is.

Governing National Reconstruction and Development

To complete the picture of a reformed financing system that deploys public capital only productively and to labor’s benefit, we need a governance process both to define and select productive enterprises and to coordinate investments in them.[xxix] Along these lines, I propose to establish a National Reconstruction and Development Council (NRDC).

In the immediate term, the NRDC would be charged with developing and executing a comprehensive yet coherent national pandemic response. Consequently, it would be tasked with (1) developing and executing a comprehensive yet coherent infrastructural reconstruction and (2) an ongoing and continually updated, labor- and productivity-aiding national development policy recognized as essential to the nation’s long-term security and well-being, along with a national defense policy and a national environmental policy.

Figure 2. Democratic Digital Dollar (“3D”) and wallet architecture. Researched and created by Robert C. Hockett. Reprinted with permission.

In light of its mission—and to guarantee a democratic structure for decision-making—the Council must comprise the heads of the Fed, the Treasury, and all cabinet-level and other relevant executive agencies with jurisdiction over national industry and infrastructure. These would include the Department of Labor, the Equal Employment Opportunity Commission, the Department of Energy, the Department of Transportation, the Federal Trade Commission, the Small Business Administration, and the Department of the Interior, among others. Members of the Council would be charged with formulating long-term development strategies within each of their respective jurisdictions and coordinating them into a single coherent and non-duplicative whole development strategy.

A Promising Future

What I have outlined here shows us the distinction between public and private investment capital and tells us why the public and private sectors must manage their own shares of the aggregate. I have provided the architectural design to enable such management. While the design may appear complex, it is actually no more than a natural extension of present arrangements and changes them only where necessary to achieve the goal. The next steps, then, are to promulgate new rules under old laws and get moving. And here, I must say, prospects have not in our lifetimes looked as promising as they do now.

The next steps . . . are to promulgate new rules under old laws and get moving. [I]t doesn’t even require cooperation from a recalcitrant Senate, should Mr. McConnell attempt to do to the Biden administration what he did to the Obama administration.

A new presidential administration takes office in January of 2021. It has pledged to spend trillions both to “Build Back Better” and to heal our nation’s racial and wealth divides. What I have proposed here is tailor-made to achieve those transformative ends. And it doesn’t even require cooperation from a recalcitrant Senate, should Mr. McConnell attempt to do to the Biden administration what he did to the Obama administration. For “Spreading the Fed”—as described above—is within existing Fed authority, while the National Reconstruction and Development Council is simply an arrangement of the existing presidential cabinet to facilitate thinking strategically about our economy as a whole. New legislation would be welcome, of course but will not be necessary.

And that sums it up. Use what we already have, but use it smarter. It is a measure of just how far we’ve fallen from creative address of our national problems that such tiny steps can be so transformative.

Notes

[i] See Robert Hockett, “The Capital Commons,” 39 Review of Banking and Financial Law 345, 2019-2020.

[ii] See, e.g., the excellent summary compiled by my former colleagues at FRBNY: Gara Afonso et Al., ‘A New Reserves Regime? Covid 19 and the Federal Reserve Balance Sheet,’ Liberty Street Economics, July 7, 2020, available at https://libertystreeteconomics.newyorkfed.org/2020/07/a-new-reserves-regime-covid-19-and-the-federal-reserve-balance-sheet.html.

[iii] See Hockett, The Capital Commons.

[iv] Ibid.

[v] Ibid. Also Robert Hockett, Money’s Past Is Fintech’s Future: Wildcat Crypto, the Digital Dollar, and Citizen Central Banking, 2 Stanford Journal of Blockchain Law & Policy 1 (2019), available at https://stanford-jblp.pubpub.org/pub/wildcat-crypto-fintech-future/release/1.

The distinction between and relations among what I call ‘credit-modulatory’ policy on the one hand and ‘credit-allocative’ policy on the other are fundamental to this author’s work of the past 12 years; failure to attend carefully to their relations accounts for a surprisingly large portion of the most salient financial and macroeconomic disasters of the past century. For essential background, see, e.g., Robert Hockett, A Fixer-Upper for Finance, 87 Washington University Law Review 1213 (2009), available at https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1367278; Robert Hockett, The Macroprudential Turn: From Institutional ‘Safety and Soundness’ to Systemic ‘Financial Stability’ in Financial Supervision, 9. University of Virginia Law & Business Review 1 (2015), available at https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2206189 (interpreting the move toward macroprudential finance oversight as reflecting long-awaited implicit recognition of the distinction’s regulatory importance).

For discussion of the practical inseparability of the conceptually distinct allocation and modulation functions, and of the consequences of this inseparability for the sustainability of our present practice of assigning allocation to Treasury and modulation to the Fed, see again Hockett, Capital Commons. And for a popularly accessible discussion of the conceptual distinction and the practical difficulty of maintaining it, see Robert Hockett, ‘Money in Context, Part 1,’ Law & Political Economy, April 8, 2020, available at https://lpeproject.org/blog/money-in-context-part-1/; and Robert Hockett, ‘Money in Context, Part 2,’ Law & Political Economy, April 9, 2020, available at https://lpeproject.org/blog/money-in-context-part-2/.

[vi] Ibid.

[vii] See Hockett, The Capital Commons for detail..

[viii] A definitive exposition, the first and apparently the only one, is Robert Hockett, Recursive Collective Action Problems: The Structure of Procyclicality in Money Markets, Macroeconomies, and Formally Similar Contexts, 3 Journal of Financial Perspectives 1 (2013), available at https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2239849.

[ix] In brief, primary capital markets are where we invest directly in firms by purchasing new stocks, bonds, or other financial instruments. Secondary markets are where we buy and sell already existing such instruments. Derivatives markets are where we buy financial instruments whose values reference other instruments – as ‘credit default swaps’ referenced mortgage-backed securities in the lead-up to the 2008 crash.

[x] See, e.g., Robert Hockett & Richard Vague, Debt, Deflation, and Debacle: Of Private Debt Write-Down and Public Recovery, White Paper, Global Interdependence Center, Federal Reserve Bank of Philadelphia (2013), available at https://www.interdependence.org/wp-content/uploads/2013/04/Debt-Deflation-and-Debacle-RV-and-RH1.pdf.

[xi] See Robert Hockett, Spread the Fed: Distributed Central Banking in Pandemic and Beyond,14 Virginia Law & Business Review __ (2020) (forthcoming), available at https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3597724.

[xii] See Robert Hockett, The Democratic Digital Dollar: A Peer-to-Peer-Savings & Payments Platform for Fully Inclusive State, Local, and National Money & Banking Systems, 10 Harvard Business Law Review 1 (2020 [2018]), available at https://www.hblr.org/wp-content/uploads/sites/18/2020/02/The-Democratic-Digital-Dollar_HBLR_FINAL.pdf.

[xiii] The FSOC, or Financial Stability Oversight Council, brings together the Fed Chair, the Treasury Secretary, and the leaders of all of the nation’s financial regulators, to enable oversight of the financial system as an integrated whole. It was established by the Dodd-Frank Act of 2010 to address the ‘regulatory siloing’ problem thought to have blinded our regulators to the gathering financial strom that broke out in 2008. The ‘People’s Portfolio’ and ‘FSOC for Development’ proposals mentioned above originate respectively with Robert Hockett, ‘The People’s Portfolio,’ Benzinga (October 2011), available at https://www.benzinga.com/news/11/10/1988109/how-to-make-qe-more-helpful-by-fed-shorting-of-commodities ; and Robert Hockett, An FSOC for Continuous Public Investment: The National Reconstruction and Development Council, 10 Michigan Business and Entrepreneurial Law Review __ (2020), available at https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3697282.

[xiv] See Hockett, Democratic Digital Dollar, and Hockett, Rousseauvian Money (working paper, 2018), available at https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3278408.

[xv] See Knut Wicksell, Geldzins und Güterpreise (1898). While you might not have heard of Wicksell, you’ve probably heard of Keynes, and ‘the Austrians.’ Fragments of Wicksell’s insights found their way into contemporary thinking through Keynes in the Anglosphere and ‘the Austrians’ beyond. But Wicksell’s followers drew only modulatory, not allocative, lessons from his work. That is a shame. Keynes and the Austrians ‘got’ the endogenous money and consequent bipolar ‘swinging’ to which Wicksell attended with ceaseless attention to detail. That’s all that Keynes’s ‘credit money’ spin on Wicksell’s ‘bank money,’ and Austrians’ ‘business cycle’ spin on his ‘cumulative process’ effectively were. That is why ‘neo-,’ ‘post-,’ ‘classical-,’ and others whom I call ‘x, y, z-Keynesians’ of all stripes fixate on the ‘macro-economics’ that they credit Keynes with inventing. And it’s why Austrians fixate on ‘taming’ endogenous money by shackling it to finite-supplied shiny metals or ‘rules.’ None of these bromides helps much, however, as the past eighty years have demonstrated. This is because you cannot get the macro right without getting the micro right. You cannot well modulate until you well allocate.

[xvi] See Hockett & Vague, Debt, Deflation and Debacle.

[xvii] This section draws upon Hockett, Capital Commons, ; Hockett, Rousseauvian Money, ; and Robert Hockett, The Dialectic of Finance (Manuscript 2017).

[xviii] Collective action predicament occurs when individually rational decisions aggregate into collectively irrational outcomes. Privately managed public capital generates similar problems in financial markets. It is individually rational to seek short-term profits. But collectively, it is irrational because it prevents productive investment and generates bubbles and busts. Ibid..

[xix] A full narrative and documentary history is in Hockett, Capital Commons.

[xx] Another tragically forgotten bit of Fed – and hence our Republic’s financial – history. And an ironic one, given the near-obsession with discounting commercial paper as the right way to central-bank on the part of Paul Warburg, the most influential Fed founder. See the brilliant Paul M. Warburg, The Discount System in Europe (1910).

[xxi] The paper was generally short term, but that was because the productive units that issued it produced over short cycles – the time lag between input and output was comparatively brief. Paper could also either be rolled over or re-issued. See ibid.

[xxii] See, e.g., Hockett, Capital Commons; Robert Hockett, National Investment in National Renewal – Three Why’s and Three How’s, 66 Challenge (2021) (forthcoming), available at https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3710240; and Robert Hockett, Public-Private Partnering in Pandemic and Beyond: Why Now for a National Investment Authority, a National Investment Council, or a Health Finance Corporation, 65 Challenge 39 (2020), available at https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3697293.

[xxiii] This section draws upon Hockett, Spread the Fed; Robert Hockett, ‘Spreading the Fed: From Federal Disintegration through Community QE to Central Bank Decentralization, Part 2,’ Law & Political Economy, August 11, 2020, available at https://lpeproject.org/blog/spread-the-fed-part-i/; Robert Hockett, ‘Spreading the Fed: From Federal Disintegration through Community QE to Central Bank Decentralization, Part 2,’ Law & Political Economy, August 12, 2020, available at https://lpeproject.org/blog/spread-the-fed-part-ii/.

[xxiv] The author has been assisting state and municipal officials to tap into the new Fed facilities. See, e.g., Robert Hockett, The Fed’s Municipal Liquidity Facility: Present and Future Possibilities and Necessities, Memorandum, May 2020, available at https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3597732; Robert Hockett, Community QE2: New Key Provisions and an Updated ‘Game Plan’ for State and Municipal Action, Memorandum, May 2020, available at https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3589851; Robert Hockett, Community QE: Key Provisions and a ‘Game Plan’ for Immediate State Action, Memorandum, April 2020, available at https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3574157. Also Robert Hockett, ‘Community QE: An April Game Plan for States and Cities,’ Forbes, April 12, 2020, available at https://www.forbes.com/sites/rhockett/2020/04/12/community-qean-april-game-plan-for-states-and-cities/#138495c03624; Robert Hockett, ‘Optimize Community QE: An Open Letter to Fed Chairman Powell,’ Forbes, June 14, 2020, available at https://www.forbes.com/sites/rhockett/2020/06/14/optimize-community-qean-open-letter-to-fed-chairman-powell/; Robert Hockett, ‘Community QE – Illinois Signs On, and Eligibility Further Expands, But ‘Penalty Rates’ Still Have to Go,’ Forbes, June 5, 2020, available at https://www.forbes.com/sites/rhockett/2020/06/05/community-qe–illinois-signs-on-and-eligibility-further-expands-but-penalty-rates-still-gotta-go/#5b593cfb18f2; and Robert Hockett, ‘Welcome to Community QE: Now Let Us Put it to Use,’ Forbes, April 9, 2020, available at https://www.forbes.com/sites/rhockett/2020/04/09/welcome-to-community-qe/#1e84d9fcc415.

[xxv] This section draws upon Hockett, Democratic Digital Dollar, ; and Robert Hockett, Financing the Green New Deal: A Plan of Action and Renewal (Palgrave 2020).

[xxvi] See Wicksell, Geldzins und Güterpreise . There is an unfortunate tendency among some contemporary economists and finance scholars, including Columbia University Economist, Michael Woodford, to interpret ‘loanable funds’ as a pre-accumulated quantum exogenously supplied by bank depositors. Wicksellian loanable funds without endogenous bank money generation is a bit like decaffeinated coffee – the very point of the thing’s been discarded. .

[xxvii] FedNow is the Fed’s project, now underway, aimed at affording real-time clearing and settlement of payments made across Fed Member Banks. See program website at https://www.frbservices.org/financial-services/fednow/index.html.

[xxviii] See Robert Hockett, Digital Greenbacks: A Sequenced ‘TreasuryDirect’ and ‘FedWallet’ Plan for the Democratic Digital Dollar, 16 Journal of Technology Law & Policy __ (2020) (forthcoming), available at https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3599419. Also Robert Hockett, The Treasury Dollar Act of 2020 (Draft Bill), available at https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3563007.

[xxix] This section draws upon Hockett, Financing the Green New Deal, Hockett, FSOC for Continuous Public Investment.

Author Biography

Robert C. Hockett is the Edward Cornell Professor of Law at Cornell University and a Regular Visiting Professor of Finance at Georgetown’s McDonough School of Business. He is also Senior Counsel at Westwood Capital, a socially responsible investment bank in Manhattan. A Fellow of The Century Foundation, he has worked at the International Monetary Fund and the Federal Reserve Bank of New York and serves as a consultant to several federal, state, and local legislators and regulators.